Know When to Fold ‘Em and Know When to Walk Away …

Pretty interesting book ….

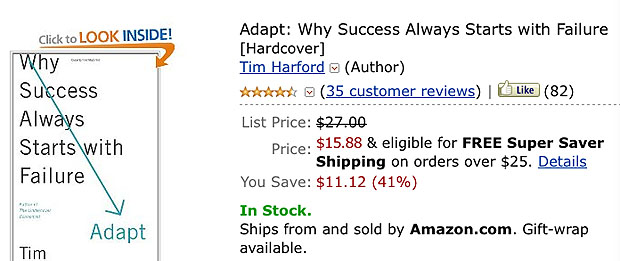

Adapt: Why Success Always Starts with Failure

Some excerpts …

“I spent the summer of 2005 studying poker. I interviewed some of the best players in the world, attended the World Series of Poker in Las Vegas, analyzed “pokerbots” — poker-playing computers — and chronicled the efforts of highly rational players, such as Chris “Jesus” Ferguson, a game theorist with a PhD who is a world champion and a formidable one-on-one player.

While poker can be analyzed rationally, with big egos and big money at stake it can also be a very emotional game. Poker players explained to me that there’s a particular moment at which players are extremely vulnerable to an emotional surge. It’s not when they’ve won a huge pot or when they’ve drawn a fantastic hand. It’s when they’ve just lost a lot of money through bad luck (a “bad beat’”) or bad strategy. The loss can nudge a player into going “on tilt” — making overly aggressive bets in an effort to win back what he wrongly feels is still his money. The brain refuses to register that the money has gone. Acknowledging the loss and recalculating one’s strategy would be the right thing to do, but that is too painful. Instead, the player makes crazy bets to rectify what he unconsciously believes is a temporary situation. It isn’t the initial loss that does for him, but the stupid plays he makes in an effort to deny that the loss has happened. The great economic psychologists Daniel Kahneman and Amos Tversky summarized the behavior in their classic analysis of the psychology of risk: “A person who has not made peace with his losses is likely to accept gambles that would be unacceptable to him otherwise.”

We tend to hang on grimly, and wrongly, to shares that have plunged.

The behavioral economist Richard Thaler, with a team of co-authors, has found the perfect setting to analyze the way we respond to losses. He studied the TV game show Deal or No Deal, which is a great source of data because the basic game is repeated incessantly, with similar rules, for high stakes, in over 50 countries. Deal or No Deal offers contestants a choice of between 20 and 26 numbered boxes, each containing some prize money, ranging from pennies to hundreds of thousands of dollars, pounds or euros. (The original Dutch version has a jackpot of 5 million euros.) The player holds one box, not knowing how much money is inside. Her task is to choose the other boxes in any order she likes. These are then opened and discarded. Every time she opens a box containing a token amount, she celebrates, because that means her own mystery box doesn’t contain that low prize. Every time she opens a box with a large prize, she winces, because that reduces the odds that her own box will be lucrative.

All of this is pure chance. The interesting decision is the one that gives the game show its title. From time to time, the “Banker,” a mysterious and anonymous figure, calls the studio to offer the contestant cash in exchange for the unknown sum inside her box. Will it be a deal, or no deal?

The psychology of the game is revealing. Let’s take a look at Frank, a contestant in the Dutch version of Deal or No Deal. After a few rounds, the expected value of his box — that is, the average of all the remaining amounts — was just over €100,000. The Banker offered him €5,000 — serious money, but less than 75 percent of his box’s expected value. He turned it down. Then he received a nasty shock. Frank opened a box containing €500,000, the last big prize remaining. His expected winnings plunged to just €2,508. The Banker’s offer plunged, too — from €75,000 to €2,400. Relative to Frank’s likely winnings, this was a more generous offer than the previous one — 96 percent of the expected value of playing on — but Frank rejected it. The next round, Frank spurned a Banker’s offer that was actually greater than the average value of the remaining boxes. And in the final round, Frank’s two remaining possibilities were €10 or €10,000. The Banker offered him a more-than-generous €6,000. Frank turned it down. He left the studio with €10. After being stunned by the loss of a guaranteed €75,000 and a decent chance of a €500,000 prize, Frank started taking crazy gambles. Frank had gone on tilt.

“Learn from your mistakes” is wise advice that is painfully hard to take.

Frank’s behavior is typical. Thaler and his colleagues looked at how people responded to the Banker’s offers immediately after making an unlucky choice, a lucky choice, or a choice that was broadly neutral. They found that the neutral choosers tended to be quite keen to accept the Banker’s deal. Lucky choosers were cocky: They were more likely to turn down the Banker and keep going. But it was unlucky choosers who stood out. They were extremely unlikely to accept an offer from the Banker. Why? Because if they did, it would lock in their “mistake.” If they kept playing, there was a chance of some sort of redemption. The pattern was all the more striking because the Banker tended to make more generous offers to losers — lower in absolute terms, of course, but closer to the average of the remaining boxes. Objectively, players who had just made an unlucky choice should have been more willing to deal than anyone, because they were receiving more attractive odds from the Banker.

Perhaps this is a phenomenon restricted to game shows and the poker tables of the Rio in Las Vegas? No such luck. The economist Terrance Odean has found that we tend to hang on grimly, and wrongly, to shares that have plunged in the hope that things will turn around. We are far happier to sell shares that have been doing well. Unfortunately, selling winners and holding on to losers has in retrospect been poor investment strategy. All four examples — poker, Paris, Deal or No Deal and share portfolios — show a dogged determination to avoid crystallizing a loss or drawing a line under a decision we regret. That dogged determination might occasionally be helpful, but it is counterproductive in all these cases and in many others. Faced with a mistake or a loss, the right response is to acknowledge the setback and change direction. Yet our instinctive reaction is denial. That is why “learn from your mistakes” is wise advice that is painfully hard to take.”

“Success always starts with failure” – in that case prepare for Cars 2 to be a success!

Never count your Cars when you’re sittin’ at the table, they’ll be time enough for couting when releases are done.

Got nervous when I first read the headline. Thought it was about cars. LOL. I know things are bad but….

And that’s why I don’t play cards for money…

I wonder if the same thing applies to collecting Cars… know when to walk away…

It would be great to walk into stores and not see a full house (pegs) of Submarine Finn McMissile over Finn McMissile…

Neat.