Apple Financial Numbers & Conference Call To Rest the Rumors

Of course, it’s a spectacular quarter in the middle of the year.

Regardless of Apple but any company that randomly announces the following numbers clearly had a great 3 months:

Net income up 73% or $818 million versus $472 a year earlier.

Revenue up to $5.4 billion versus $4.4 billion a year earlier.

That’s $58.7 million a day in revenue BTW or about $8.9 million a day in profits.

How do you get there?

1.76 million or about 19,000 Macs a day with 50% of the Apple store sales to WIN users (according to Apple). That’s 33% better than a year earlier and about 3 times the growth rate versus the rest of the industry. Here’s our reasoning why the I’M A MAC ads work.

By selling 7,500 iPod’s every minute – at a 20% HIGHER rate than the year before – or nearly 10 MILLION iPods in 92 days.

Pretty impressive knowing that a touchscreen iPod (and iPhone) of course was coming for $600. Of course, sales growth didn’t match volume growth but that’s to be expected. Since January, people knew the form & functions of the iPhone doubling as an iPod AND also presuming that the widescreen would be the new format for the iPod, sales would be at the lower SHUFFLE & NANO line – the Shuffle line is brilliantly priced – expensive but inexpensive enough to make it an extravagant but elegant gift that works for young, old, colleagues, friends, etc … (twice now, I’ve seen someone buying all the colors at once – crazy exercise scheme or extravagant party favors?) While other DAP/MP3 sellers throw new shapes, money losing versions and new music stores at the marketplace, only the iPod is the one brand respected and acknowledged by all as “the one.” So in a year where the only change was adding the RED charity version, IPOD sales continue to march through like hot knife & butter.

The new widescreen iPod will once again ignite sales whenever it comes out – but presumably before the holiday selling season.

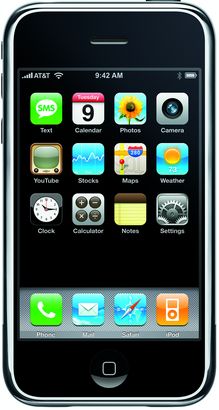

And of course, selling 270,000 iPhones in 30 hours or about 150 a minute … I think it’s safe to say that most cell phones do not sell at a rate of 150 a minute for the first 30 hours.

(And of course, our favorite mule to kick – the Zune sells about 30,000 a month or about 9 months to also sell 270,000).

And of course, buying an iPhone is a monthly revenue stream for Apple in the form of AT&T’s fees back to Apple, to iTunes sales and presumably another halo to selling more iPods and more Macs. (one source quoted AT&T as saying 40% were new to iPods).

By the end of next Q, it should be clear what the initial numbers are/were for the iPhone.

As part of the conference call, it became clear that some of the rumors concerning a “nano iPhone” are just that and certainly not coming out this holiday season because as Apple noted, “We’re here for the LONG TERM.”

Apple is launching the iPhone in Europe in the next few months and early in 2008 for Asia. Whether they add 3G or not is another matter but as for the form, why is Apple going to spend all this time establishing this AS the iPhone only to throw it away in 3 months?

When it’s NOT even available anywhere else?

Do I think there might a smaller iPhone sometime in the future – sure – but in the next few months before EVERYWHERE but the United States (Not even Canada) has one?

No.

If you brand THIS iPhone as the MUST HAVE item as it sweeps across the globe – why would you start over by selling a DIFFERENT one AND a LESS PROFITABLE one?

You don’t.

There is also NO reason to cut profits to sell a cheaper iPhone just yet. You don’t create aspirations for owning a “special” item and then undercut it by discounting or bringing out a cheaper one right away. That’s the playbook of Motorola and you see how they can smash & grab some sales & market-share for a few quarters but then by driving the price down & down pointlessly, you have driven the brand value to ZERO.

The iPhone will follow the iPod and technology. It will be in versions bigger (physically as a ultra portable maybe) and it will get smaller and presumably cheaper but at some point in the future when nearly EVERYONE who is willing to pay $599 for a phone has one AND NOT A SECOND BEFORE.

That’s when you smartly strip out features or add in features only available at the top-of-the-line like Apple with the gulf of difference between a SHUFFLE, a NANO and an IPOD … or the MINI, IMAC & MACPRO and then price it accordingly.

So, maybe a year from now, after the world from Zanzibar to Altoona all have an iPhone, then iPhone 2 will be out … don’t worry, AT&T will be happy to reset your 2-year contract at 2 years again with a new extension activation fee.

Oh and two last numbers to consider. A lot of people are noting that Apple’s PE ratio is a bit high in comparison to other tech or software/hardware companies but they seem to neglect looking further down the report and noting that Apple is sitting on over $13 BILLION in cash and has a long term of $0.

That’s right – long term debt – ZERO.

Just like the numbers in my household … or maybe vice versa 🙂

(For investors or those holding Apple stock who want to gloat – Motley Fool has pulled together all the important numbers).